welcome

TO BUILDLOAN

Specialist Homebuilding Finance for Intermediaries

Lender Fair Value Assessments Click Here

How can we help you today?

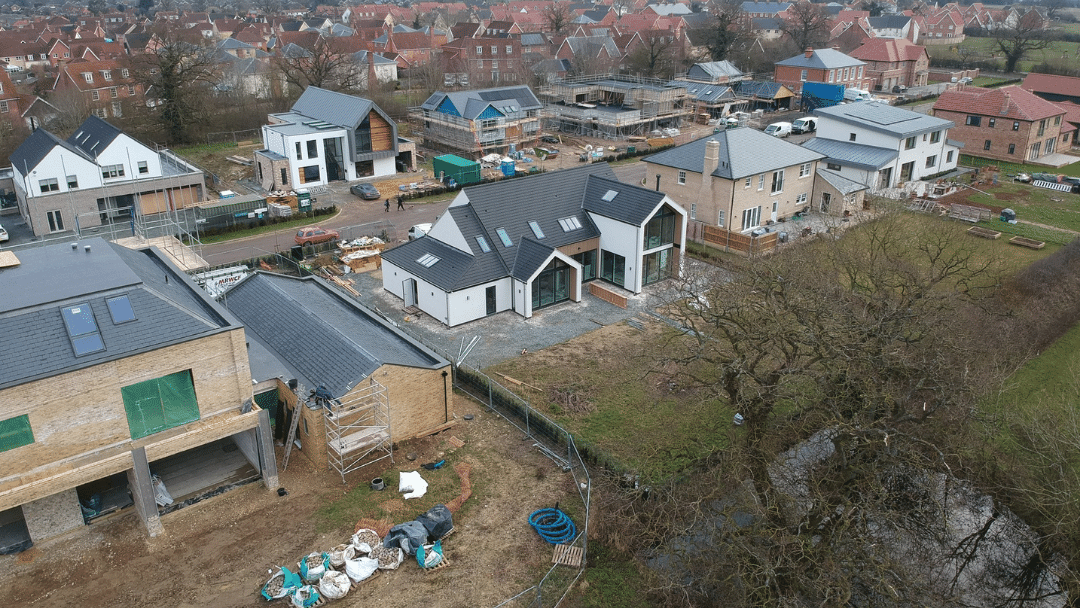

As the UK’s leading distributor of funding solutions for homebuilding projects, we can help you source the most suitable product for your homebuilding clients. Whether it’s for their main residence as a self build, renovation, conversion, custom build, home improvement, knockdown and rebuild, or a project of any scale to sell or let – we’ve got the right solution.

Your online mortgage platform is open for business 24/7

Unicus offers a seamless application, information and support process, allowing you to identify and arrange the right product for your client and arrange their finance online – at a time to suit you. Open 24/7, you can easily submit and track your business.

Register or login to get started.

Why BuildLoan?

At BuildLoan, our processes and products have been designed to protect you, your client and the lender and mitigate the risks associated with traditional self build mortgages. We provide a safety net for everyone involved, ensuring the project gets done without any fear of running out of cash midway through the build.

Latest News

BuildLoan offers new larger loan products and increased income multiples for higher income self builders

BuildLoan has increased its range of self and custom build mortgages with the launch of two products funded by Furness Building Society. The new deals offer loans up to £1m and up to five times the applicants' income for those earning above £100,000. Loans of up to...

BuildLoan launches new stage payment product to protect against down-valuations

BuildLoan has launched a new advanced stage payment product with Chorley Building Society, which protects clients against the risk of cautious site valuations. The new deal is specifically designed to overcome the risk of a down-valuation disrupting the clients'...

BuildLoan increases range of exclusive self and custom build products

BuildLoan has announced a new range of advance stage payment products funded by Hinckley and Rugby Building Society. The new products give self builders up-front funding to cover each stage of their building project. Up to 90% of the cost of each stage of the project...