how to advise on renovations, conversions & home improvements

Understand the challenges that your clients are likely to face with these types of projects and how your advice is absolutely pivotal in their success.

Key aspects to consider when advising and making a recommendation.

When it comes to advising on renovation, conversion and home improvement projects, you’ll find BuildLoan can offer a number of distinct advantages to help your clients get their plans underway.

BuildLoan’s new mortgage platform Unicus will generate a range of suitable products for each of these project types, against which you can advise.

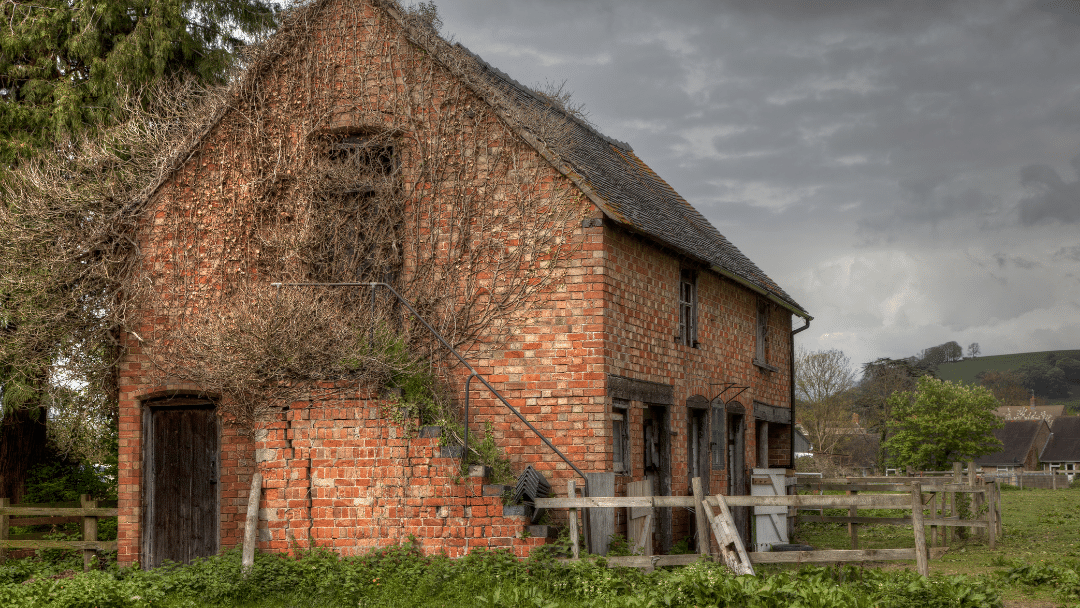

Is the property habitable?

To be classed as habitable, the property will need to have a working kitchen, bathroom, running water, stairs but you may find valuers will deem a property uninhabitable or unsuitable for a mortgage for other reasons too.

As a broker, you are taught that if a house isn’t habitable, it isn’t mortgageable – which isn’t true, because we can do it!

Valuation risk?

With a barn conversion, the first stage of works often results in the property being devalued because of removal or repairs to the roof, windows and remedial work to the superstructure.

A traditional arrears stage payment mortgage relies on the property’s value increasing after every stage is completed. BuildLoan has the solution.

Insufficient equity in current property?

Many customers think they can’t extend because they don’t have sufficient equity in their existing property. That’s because traditional lenders will only lend against the property’s current value.

With BuildLoan, your clients can borrow against the value of the property once the works are complete.