welcome

TO BUILDLOAN

Specialist Homebuilding Finance for Intermediaries

Lender Fair Value Assessments Click Here

How can we help you today?

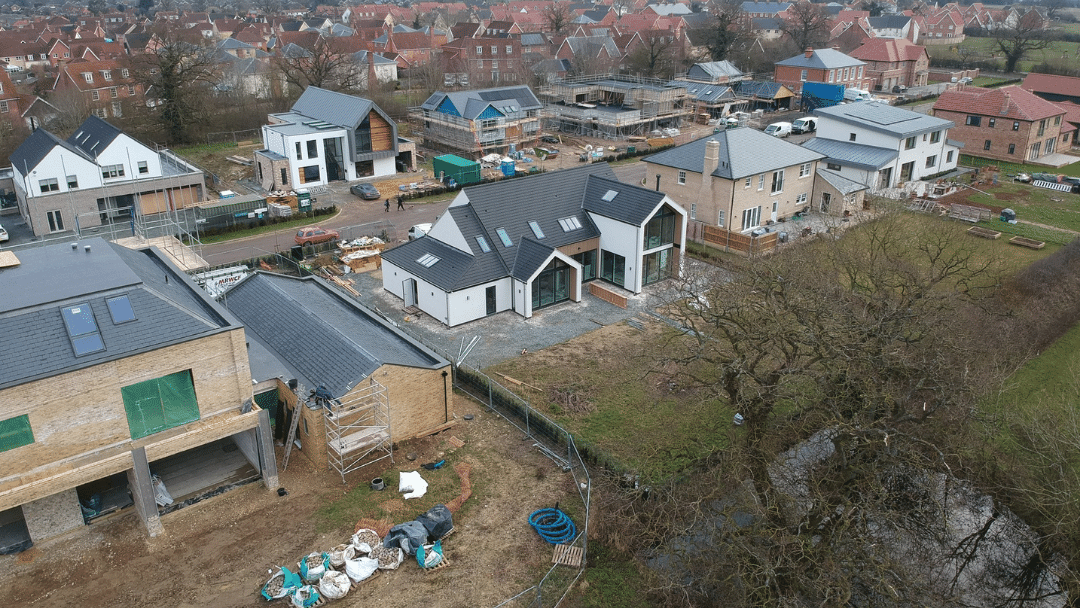

As the UK’s leading distributor of funding solutions for homebuilding projects, we can help you source the most suitable product for your homebuilding clients. Whether it’s for their main residence as a self build, renovation, conversion, custom build, home improvement, knockdown and rebuild, or a project of any scale to sell or let – we’ve got the right solution.

Your online mortgage platform is open for business 24/7

Unicus offers a seamless application, information and support process, allowing you to identify and arrange the right product for your client and arrange their finance online – at a time to suit you. Open 24/7, you can easily submit and track your business.

Register or login to get started.

Why BuildLoan?

At BuildLoan, our processes and products have been designed to protect you, your client and the lender and mitigate the risks associated with traditional self build mortgages. We provide a safety net for everyone involved, ensuring the project gets done without any fear of running out of cash midway through the build.

Latest News

BuildLoan expands large loan mortgage range with Darlington Building Society

Leading self and custom build mortgage distributor BuildLoan has launched a new product range with Darlington Building Society offering mortgages up to £1.5m. The products offer clients wanting to build their own home - either independently or on one of the growing...

BuildLoan launch new low-fee self build products with guaranteed stage payments

Self build experts BuildLoan have added two new low-fee products to their range in conjunction with Hinckley & Rugby Building Society. The two products offer BuildLoan’s guaranteed stage payments during the build, linked to the cost of each stage of work without the...

BuildLoan and Nottingham Building Society launch new range of cost based mortgages

BuildLoan has worked closely with Nottingham Building Society to launch three new cost based self build mortgage products All of the new range offers funding up to £600K and up to 80% of the client's project costs along with the option of interest only during the...