construction types

As a mortgage adviser, it’s unlikely you’ve got in-depth knowledge of different types of construction. But, you will need to consider the construction type when making your recommendation.

Construction type will influence your clients’ cashflow requirements.

When it comes to recommending a mortgage for your client, it’s essential to take into account the construction type. Sourcing systems don’t have any questions relating to construction, but certain features such as timber cladding can immediately limit the number of available lenders for your client.

Clients may already have beautiful architect designs. It can be costly to get these designs redone because they include features that make obtaining a mortgage difficult. BuildLoan’s broker desk can quickly let you know which lenders are likely to accept your clients’ project and any features that you should be aware of that may limit their choice of lenders.

It’s also worth keeping in mind current materials shortages in the UK. This makes incorporating adequate contingency into your clients’ budget more important than ever, to protect them from price hikes. Accurate costings help avoid any unpleasant shocks along the way. BuildLoan offers a Mortgage Cost Forecast Service that ensures costs are realistic and take into consideration possible price increases. A cost based mortgage will provide guaranteed stage payments based on their project costs providing certainty of available funds.

Brick and Block

Brick and block can be one of the cheapest construction types. Most builders would prefer to build in masonry, so builders tend to price a bit more competitively, and of course there are lots of self builders who are in the trade, so they have more chance of getting rates from mates or family in the trade, than they will from a timber frame company.

The UK is currently experiencing a brick shortage and higher prices – up to 30% more than usual. It is vital that your clients build in a contingency of at least 20% to cover any hikes in prices.

Timber Frame

Timber frame build systems are very popular with self builders as they’re efficient – both thermally and from a speed of construction perspective. They are designed and manufactured off-site and then delivered and erected on site.

The manufacturer will need paying some money on deposit, some during manufacture and some on delivery so your client needs to be able to fund that superstructure at an early stage. They will either need a lot of savings and then the lender will reimburse them once the property has reached wind and watertight or they need a mortgage that will release funds in accordance with those cashflow requirements. For most people, advance stage payments offer the perfect solution.

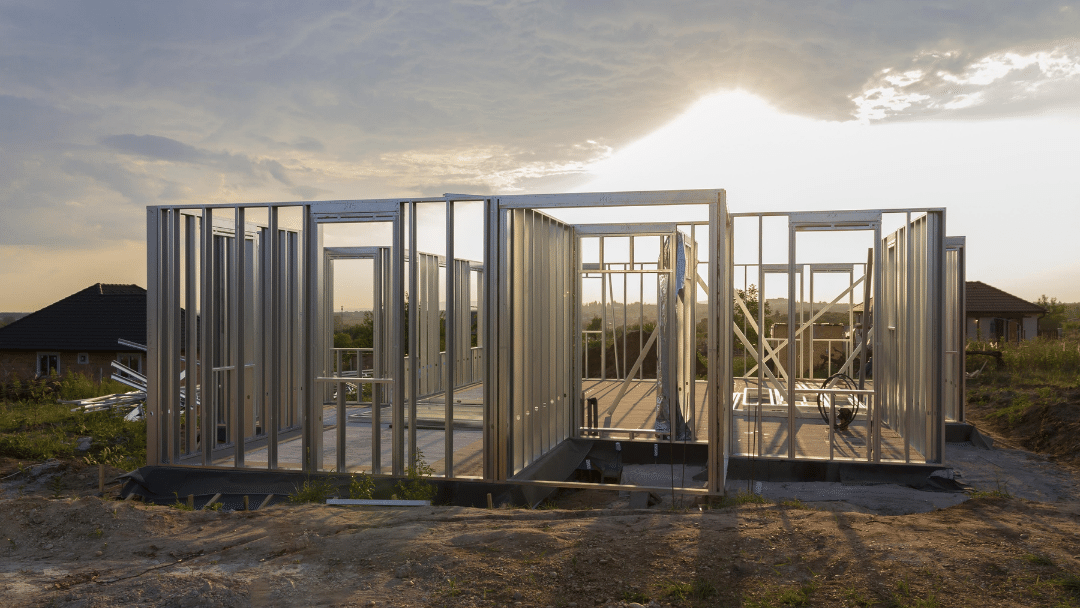

Insulated Concrete Formwork (ICF)

Insulating concrete formwork (ICF) or permanently insulated formwork (PIF) is an insulated in-situ concrete system of building that is quick to construct, providing a practical and energy efficient method of building insulated walls for houses.

ICF’s interlocking blocks are sometimes referred to as lego for grown ups. A ICF home will have a short construction time and funds will be required to pay for the home design before delivery. Once again, with ICF costs will be higher earlier in the build, so it’s important your client’s cashflow is tailored to their individual requirements.

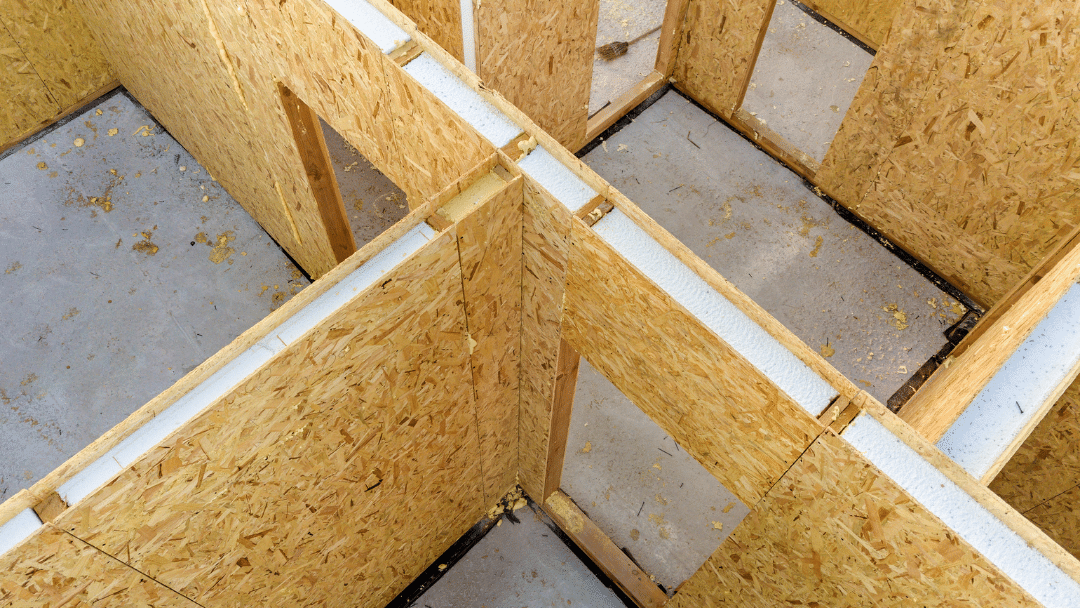

Structural Insulated Panels (SIPS)

Structural Insulated Panels can be manufactured offsite and delivered to site. They are rigid panels of foam or polystyrene that are sandwiched between Oriented Strand Board (OSB). The panels can be put together quickly to create the structure of your clients’ bespoke home.

SIPs are popular because of their thermal ratings and the speed of construction. If you have customers looking for a mortgage for a SIPs property, get in touch with our broker desk to discuss their options.