Bridging loans

As a mortgage adviser, bridging can solve many short term cashflow problems for your clients while offering you a lucrative income.

Bridging loans bridge the gap between when a client needs funding and when they can access more traditional forms of finance.

As a mortgage adviser, you can use this type of finance to solve a variety of client problems, such as funding the purchase of a property before selling their existing one or refurbishing a property before taking out a mortgage. Bridging loans can also help customers raise capital for business purposes or cover unexpected expenses.

The main advantage of bridging finance is that it can provide your clients quick access to funds when needed.

Bridging loans are typically repaid over 12 months if regulated or up to 24 months if unregulated.

Why Buildloan?

BuildLoan is master broker in short term finance and our dedicated short term funding team can provide you with 1-2-1 support and obtain the most competitive deal for your clients with bridging rates starting from 0.63%.

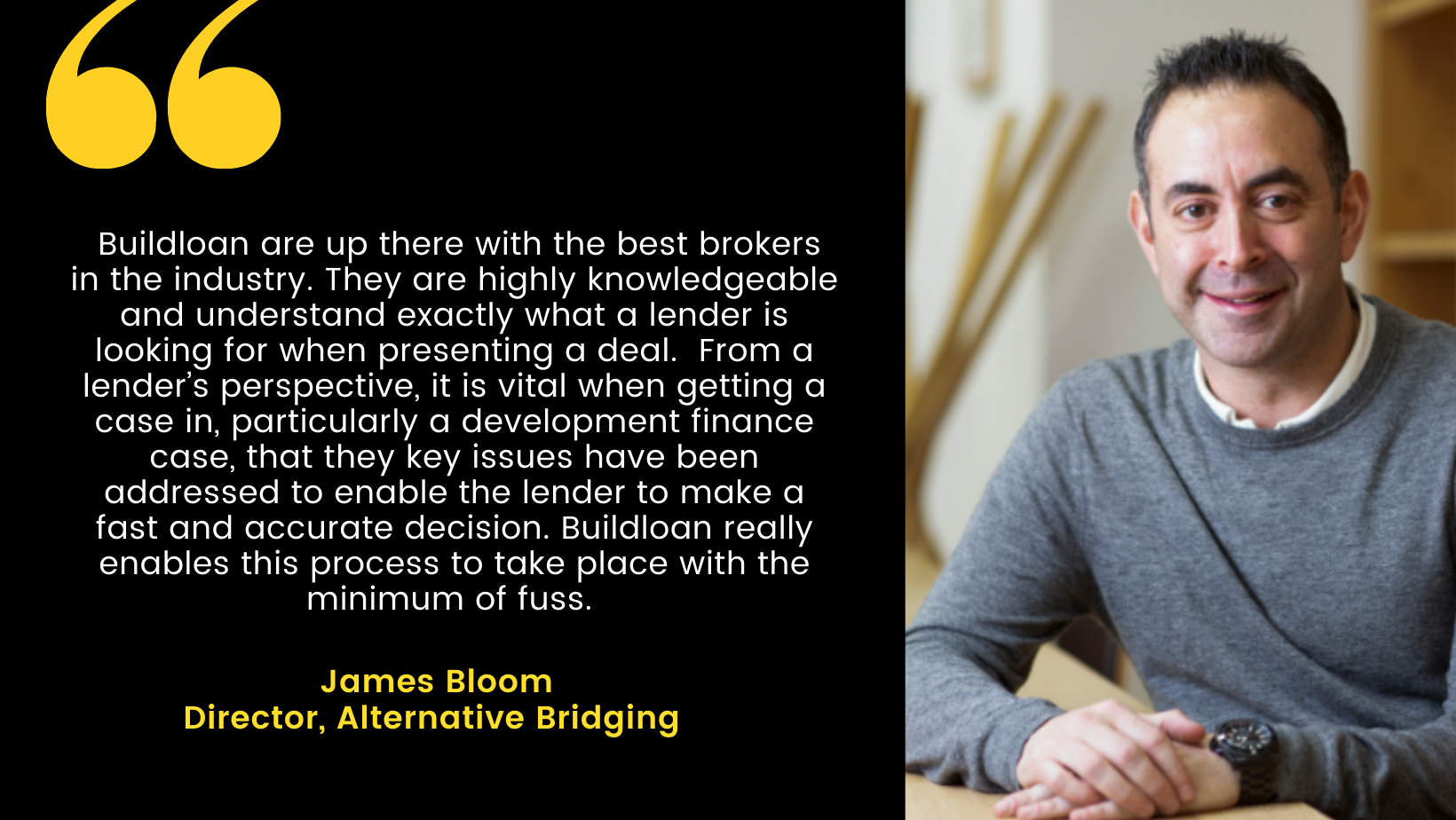

Because of BuildLoan’s premier panel status with lenders, you can access lower rates than by going direct to a lender and enhanced procuration fees. You will also benefit from our vast experience in this sector – over 35 years – which allows us to holistically review your customer’s situation and come up with creative solutions to resolve cashflow problems.

We have first class relationships with all of the leading lenders and bridging distributors which means we can find the right solution for your clients, whatever their circumstances.

Working with BuildLoan gives you unparalleled access to lenders and underwriters and helps you access the right advice for you and your clients.

let’s talk!

Complete our short form and we will contact you to discuss your client’s requirements. Alternatively call us on 0345 347 0250